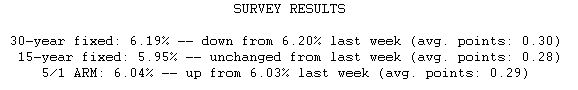

Mortgage rates remained low on evidence of slower economic growth. Last week, the fourth quarter Gross Domestic Product was revised sharply lower. This week, both productivity and factory orders came in lower than forecast. Although a survey of the manufacturing sector was stronger than expected, the larger services sector slowed notably. The prospects for slower economic growth help buoy demand for Treasury securities, pushing bond prices higher and yields lower. Mortgage rates are closely related to yields on long-term government bonds.

Fixed mortgage rates are notably lower than last summer when the Fed last raised interest rates. At the time, the average 30-year fixed mortgage rate peaked at 6.93 percent, and a $165,000 loan carried a monthly payment of $1,090.00. With the average 30-year fixed rate now 6.19 percent, the same loan originated today would carry a monthly payment of $1,009.50. Fixed mortgage rates are a compelling refinancing alternative for adjustable rate borrowers facing sharp payment adjustments.