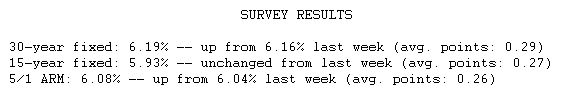

Mortgage rates were up slightly as renewed inflation worries made it unlikely the Fed would trim interest rates any time soon. Larger than expected increases in the Consumer Price Index (CPI) and Producer Price Index (PPI) for February made it clear that inflation has yet to fade into the background. With inflation still on the Fed's radar screen, any likelihood of a Fed rate cut in the coming months was dimmed. Bond yields and mortgage rates both increased slightly. Mortgage rates are closely related to yields on long-term government bonds.

Fixed mortgage rates are notably lower than last summer when the Fed last raised interest rates. At the time, the average 30-year fixed mortgage rate peaked at 6.93 percent, and a $165,000 loan carried a monthly payment of $1,090.00. With the average 30-year fixed rate now 6.19 percent, the same loan originated today would carry a monthly payment of $1,009.50. Fixed mortgage rates are a compelling refinancing alternative for adjustable rate borrowers facing sharp payment adjustments.